After six months of continuous decline, the price of lithium carbonate has recently ushered in a strong rebound.

Astounding Rebound

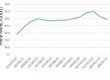

On May 18, according to the latest data, the price of battery-grade lithium carbonate rose by 15,000 yuan/ton, with an average price of 300,000 yuan/ton. During this month, lithium carbonate has seen a daily increase of more than 10,000 yuan/ton many times. It has risen by 121,500 yuan/ton from the low point of 178,500 yuan/ton in late April. The rebound rate is astounding.

Lithium mining

14 Consecutive Increase

Specifically, since the end of April, the price of lithium carbonate has bottomed out and rebounded, and the price of lithium carbonate has achieved a rare fourteenth consecutive increase.

In less than a month, the price of battery-grade lithium carbonate has risen from 180,000 yuan/ton to 300,000 yuan/ton. In the process of this round of lithium carbonate price reversal, the change of supply and demand relationship is the main reason

When the price of battery-grade lithium carbonate fell below 200,000 yuan/ton, the trading volume in the market dropped sharply.

However, when the price is lower than the production cost, manufacturers reduce production and control shipments, the price of lithium carbonate rebounds and continues to rise, which drives the sales of lithium carbonate, and also drives the active production of material companies and power battery companies

Since the beginning of this year, due to the slowdown in the growth rate of demand for EV and the inventory backlog caused by power battery manufacturers , the operating rate of domestic battery manufacturers’ production capacity is generally only 40-50%.

However, with the gradual reduction of previous inventory, the market in the second quarter that has already started has undergone positive changes.

CATL, EVE and other manufacturers all believe that the market is gradually improving, cathode material factories have more motivation to destock, and the effect is quite significant. The manufacturer believes that “regardless of the industry or the company, the worst time has passed.”

Energy Storage Batteries

In addition, in the field of energy storage batteries, the overall energy storage market in Q1 was left on the sidelines due to the fierce drop in lithium carbonate prices, which affected shipments in the first quarter and also prepared for the energy storage market in the next three quarters.

China’s domestic energy storage lithium batteries have gradually entered the peak season starting from Q2, and the delivery of energy storage batteries has been accelerated. Ningde Times predicts that the growth rate of the energy storage industry will be higher than that of power batteries this year.

Different Views

However, many people in the industry believe that it is difficult for the price of lithium carbonate to return to the continuous upward trend, and it is even more difficult to return to the high point at the beginning of the year.

The price of lithium carbonate may still rise in the short term, but whether it can continue to rise in the end still needs to pay attention to the trend of demand.

Considering that the recovery of demand is relatively mild, it will still take some time to digest the inventory of the industrial chain, and the possibility of a short-term rebound in lithium prices to cover the current high lithium mine costs is not high, and the price protection strategy of lithium mine miners is difficult to maintain for a long time.