The competitive landscape of the lithium battery industry is changing dramatically, which is bringing unprecedented challenges to the supply chain of lithium battery materials.

The arrival of the TWh era is simultaneously bringing opportunities and challenges to the upstream material industry chain of lithium batteries.

Tesla Gigafactory of EVs in China

Opportunity

with the accelerated development of the global automotive electrification and energy industry, the demand for lithium batteries continues to grow, and the expansion of power battery production intensifies, bringing huge industrial opportunities to lithium battery material companies.

Challenge

The contradiction between supply and demand of lithium battery materials is still tense, the industry competition is fierce, and there is a continuous game between OEMs, battery factories and upstream material suppliers

It is estimated that by 2030, the global demand for lithium battery capacity will reach 7TWh,in 2021, the exponential growth of the new energy vehicle and lithium battery energy storage market has led to a substantial increase in the production of lithium batteries, which in turn have generated strong demand for various lithium battery materials.

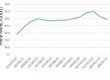

Among them, the prices of lithium carbonate, lithium hexafluorophosphate, PVDF, lithium iron phosphate, etc. have increased by over 750%, 420%, 400% and 350% respectively in 2021 compared with the end of 2020, and the prices of raw materials such as graphite, iron phosphate and monoammonium phosphate also have had 1- 2x increase.

Market change

However, with the accelerated expansion of production by material companies and the adjustment of downstream market demand, the prices of the above-mentioned materials have been gradually declining in 2022.

It is worth noting that the price of lithium carbonate has entered an upward channel again, and the recent quotation has returned from 450,000 yuan / ton to about 470,000 yuan / ton. The possibility of breaking through 500,000 yuan/ton is not ruled out during the year.

It is expected that by the end of 2022, except for lithium mines, if the planned production capacity of other lithium battery raw materials can be put into production on schedule, the production capacity dilemma will be solved.