The strategy of CATL is very suitable for the currently increasing global LFP battery installation.

The hype surrounding electric vehicles has raised expectations for the next generation of long-range batteries that will not only extend the range of the car, but also have the right cost.

But new technological advances and major breakthroughs are not necessarily the way forward. As one of the world’s largest electric vehicle battery companies, the success of China’s CATL is a good example.

CATL has adopted existing technology to successfully lower battery prices and convince automakers that the final product is a worthwhile investment. This is no easy task, but doing so has kept CATL’s gross quickly over the past few years.

Charging and storing

CATL’s shares have risen sharply so far this year as enthusiasm for installing LFP batteries has grown.

This is in stark contrast to current industry trends, where car and battery makers are stumbling for better and cheaper batteries, struggling with material compositions, production processes and chemistries.

Companies are pouring billions of dollars into building new factories and developing next-generation powertrains that allow cars to go farther and longer. At the end of the day, automakers are announcing recalls, faulty batteries are on fire, and EVs, of which the cost of batteries account for about half, remain prohibitively expensive.

Pragmatic

CATL has always been pragmatic. The company has taken lithium iron phosphate (LFP) battery technology, which is considered relatively low-end, and has made it widely available in passenger cars.

CATL also redesigned the battery pack to achieve higher energy efficiency with fewer components. Although the energy density of this battery is lower, and the battery life is not as long as the battery using the new chemical technology, it is safe and reliable, and has improved in quality and durability.

The procurement of raw materials for such batteries is also not that difficult. This is an important point for manufacturers currently trying to obtain and maintain a steady supply of raw materials such as lithium and cobalt.

Although CATL has adopted newer technologies in the production of other types of powertrains, it has now made LFP batteries a business focus.

Other manufacturers in the market saw the opportunity, including Elon Musk, the man behind the electric car boom.

CATL has signed supply agreements with manufacturers including Tesla Inc. and Volkswagen AG, boosting market confidence in low-end batteries.

More and more Tesla vehicles made in China are now equipped with LFP batteries.

Iron batteries

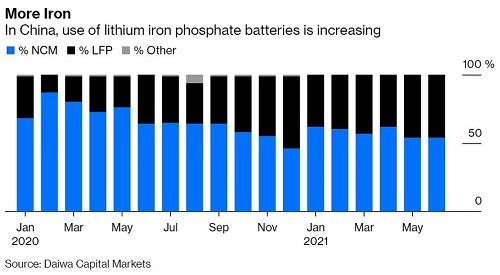

Rising proportion of “iron batteries”: The use of lithium iron phosphate batteries in China is increasing.

It makes sense. Right now, even if an electric car can travel hundreds of miles, the return trip is still a problem because charging stations are still relatively scarce.

But this range is enough for everyday use: a Tesla Model 3 with an LFP battery can travel 468 kilometers.

Nickel-cobalt-manganese (NCM) batteries have a longer range, around 500 to 600 kilometers, with some new models advertised as 700 kilometers.

But such batteries are less stable at high temperatures, and the manufacturing process is much more expensive. Commercializing NCM cells at a scale that does help profitability has proven difficult.

Meanwhile, battery makers such as South Korea’s LG Chem Ltd., SK Innovation Co. and Samsung SDI Co. have insisted on making more expensive lithium-ion batteries that contain a lot of nickel.

LFP batteries may not be the way of the future, but the market share they occupy shows that people’s ideas are gradually becoming a reality.

It’s an encouraging sign at a time when ambitious environmental goals are everywhere. Global LFP battery installations are increasing, reducing the overall cost of EVs and alleviating a longstanding problem that EVs tend to be more expensive than ICE vehicles. As you can see, big goals don’t always guarantee victory, or even crossing the finish line.