IEA: Battery pack prices could rise 15% this year, lithium production needs to increase six fold by 2030

Tags: Power batteries, new energy vehicles, electric vehicles

In 2021, though, battery prices will fall by 6% to $132 per kilowatt, according to the IEA report. If the price of battery metal materials stays at Q1 levels in 2022, the pack will be 15% more expensive than in 2021 based on the condition that all else being equal.

EV Sales doubled

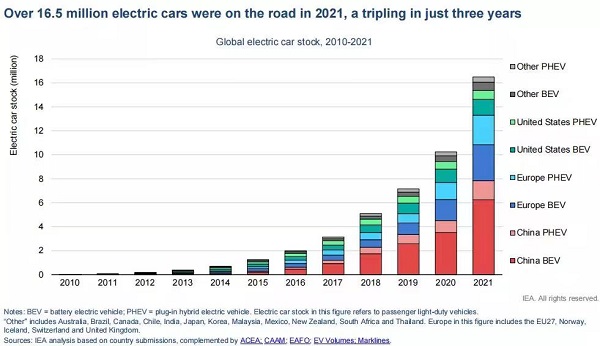

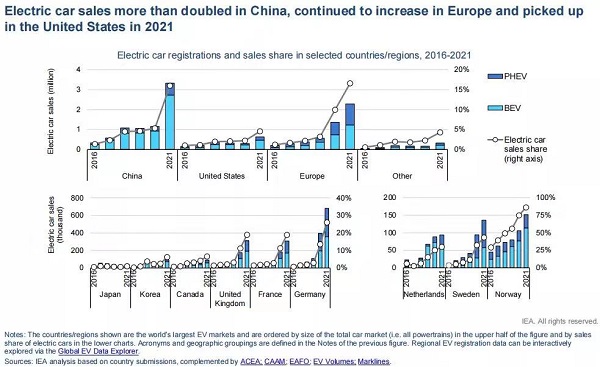

According to International Energy Agency (IEA) on May 23, about 6.6 million electric vehicles will be sold globally in 2021, almost double that in 2020. Electric vehicles accounted for 10% of new car sales, four times their market share in 2019. In 2021, the total number of electric vehicles on the world’s roads will reach about 16.5 million, double the number in 2018.

The Chinese market accounted for about half of EV sales in 2021, with 3.3 million vehicles sold, surpassing global EV sales in 2020.

The price gap between Chinese electric vehicles and their competitors is narrowing, while research and development and manufacturing costs are also falling, according to the report. In 2021, the median sales-weighted price of electric vehicles in China is only 10% higher than that of conventional vehicles, while the average price in other major markets is 45% to 50% higher. China is also building charging infrastructure faster than most other countries and regions.

In emerging markets such as Brazil, India and Indonesia, sales of electric vehicles are still lagging, accounting for less than 0.5 percent of new vehicles, the report said. However, EV sales in many countries, including India, are doubling in 2021, and could grow even faster if policies and investments are in place.

Global strong growth

Global electric vehicle sales maintained strong growth in the first quarter of 2022, with a year-on-year growth rate of 75%. Among them, sales in China more than doubled from the same period in 2021, while those in the United States rose by 60 percent and those in Europe by 25 percent.

Continued support policies are the main driving force behind the growth in electric vehicle sales. Global public spending on electric vehicle subsidies and incentives nearly doubled to nearly $30 billion in 2021.

A growing number of countries are pledging to phase out internal combustion engines in the coming decades or to set ambitious targets for electrifying vehicles.

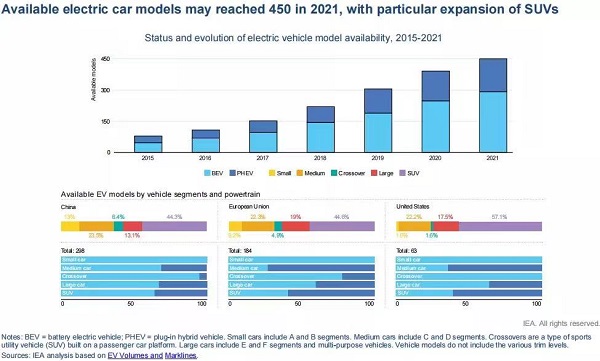

At the same time, many automakers are also accelerating their transition to electrification, often going further than policy goals. In addition, the number of electric vehicle models offered by automakers increased to about 450 in 2021, a fivefold increase since 2015, increasing their appeal to consumers.

Under the IEA’s stated policy scenario, the number of electric vehicles in the world is expected to reach about 200m in 2030 (about 11 times the current number), accounting for more than 20 per cent of global vehicle sales.

Rising costs

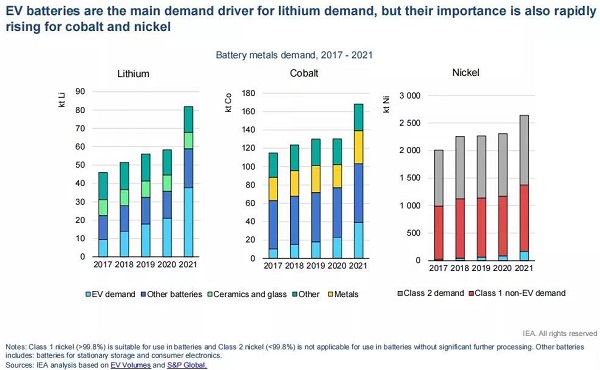

The IEA also noted that tight supply and the risk of rising costs could slow growth in the electric vehicle sector. From the beginning of 2021 to May 2022, lithium prices rose more than sevenfold, cobalt prices more than doubled, and nickel prices nearly doubled (to their highest levels in nearly a decade).

According to the IEA, the surge in battery metal prices since 2021 has been driven by three factors: pressure on production due to COVID-19; Second, concerns about the supply of primary nickel from Russia; From 2018 to 2020, the price of battery metal materials is at a low level, and investment enthusiasm is not high.

Battery prices fell 6 per cent to $132 per kilowatt in 2021, but less than the 13 per cent decline in 2020, due to higher material prices, the IEA said. If the price of battery metal materials stays at Q1 levels in 2022, the pack will be 15% more expensive than in 2021, based on that all else being equal.

Higher prices are usually accompanied by an increase in the supply of new mines or an extension of the life of existing mines. High battery metal prices are likely to spur a lot of supply-side investment to make up for weak commodity prices. The IEA estimates that lithium battery production will need to increase six fold by 2030, with 50 new mines, to meet growing demand.